The GENIUS Act, which sets out a framework for stablecoins in the US, has received the lawmakers' approval in the House of Representatives, clearing its way to become the first major crypto law in the country.

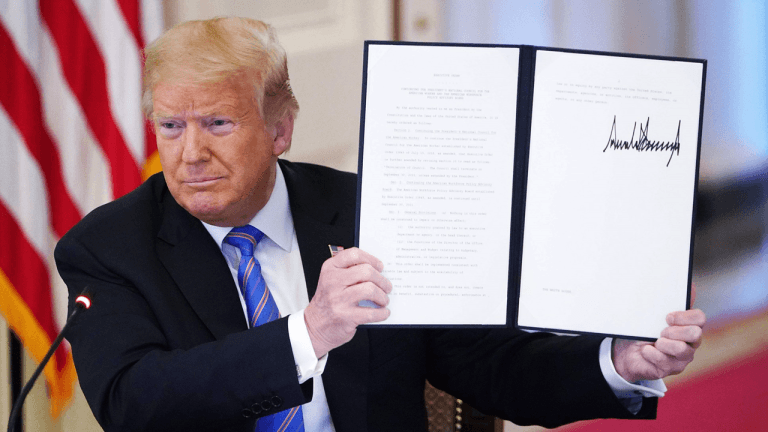

A Signature Away from Becoming Law

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act now only needs President Donald Trump’s signature to take effect.

After receiving the Senate’s approval earlier, the Act got the final green light from the House of Representatives with a 308–122 vote in favour. More than 100 Democrats voted in favour of the GENIUS Act.

Related: Citi “Is Looking at the Issuance” of a Stablecoin: CEO Confirms

“By moving from regulation through enforcement to clear rules, the US will strengthen its place as a global leader in cryptocurrencies and may encourage other countries to follow,” said Yuval Rooz, CEO and co-founder of Digital Asset.

Once enacted, the Act will require any firm issuing a payment stablecoin to:

Fully back each token with cash or short-term US Treasury securities held in segregated reserves;

Obtain a bank charter or a new federal or state “qualified” stablecoin licence;

Publish a detailed monthly reserve report;

Meet basic capital, liquidity, and anti-money-laundering standards;

Avoid paying interest simply for holding the coin.

By setting these basic rules, Congress aims to protect users, prevent runs, and give banks, fintechs and investors a clearer legal path to use dollar-backed digital cash with more confidence.

“With the passing of the GENIUS Act and major firms like Amazon and Walmart said to be exploring stablecoin-type payment models, it’s clear that digital assets are entering everyday use,” said Laurent Descout, CEO and co-founder of Neo.

“With clearer rules now in place, stablecoin use could grow quickly, and treasurers should be looking at the right partners and systems now to stay ahead,” he explained.

Read more: Congress on the Clock: Can 2025 Deliver Real Crypto Reform in the US?

US Lawmakers Back Crypto Bills

Besides the GENIUS Act, the House also voted in favour of two more crypto-related bills: the Digital Asset Market Clarity (CLARITY) Act, which aims to set a market structure for cryptocurrencies, and the Anti-CBDC Surveillance State Act, which would stop the Fed from launching or testing a retail central bank digital currency.

The CLARITY Act received 308–122 votes in favour, while the anti-CBDC bill passed with a 219–210 vote.

While the CLARITY Act now moves to the Senate, the Banking Committee is expected to hold a markup later this summer, though no Senate floor date has yet been set. The anti-CBDC bill also awaits Senate approval.

This article was written by Arnab Shome at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments