TLDR: Cryptocurrencies can either be classified as securities or commodities. This determines how strictly they are regulated, as well as how they are taxed. Gary Gensler and the SEC are pushing for cryptocurrencies to be considered securities, and the crypto community is pushing back.

You're probably seeing a lot of news right now about the SEC hearing, and you might be wondering what exactly the big fuss is about. In a nutshell, there's no consensus on whether to classify cryptocurrencies as commodities or securities. Let's take a look at what this means.

Definitions

All assets can either be classified as securities or commodities.

- Commodities are basic goods or raw materials that can be owned or traded. They are used in the production of consumer goods. Oil, grains, meats, precious metals, are examples of commodities. Some financial assets like currencies and indices are considered commodities.

- Securities are more broadly defined, but are generally financial instruments that can be traded and hold monetary value in the form of equity or debt.

In general, neither definition can be applied to all cryptocurrencies in general. Classification must be done on a case by case basis.

The Howey Test

The Howey Test is a test used to determine if something is a security, stemming from a 1946 US Supreme Court case. According to the Howey Test, an asset is a security if it meets all of the following conditions:

- there is an investment of money,

- in a common enterprise (aka a business venture),

- with expectation of profits,

- derived from somebody else's effort.

Clearly, some cryptocurrencies do not pass the test (Bitcoin), whereas some clearly do (any coin that had an ICO). The Howey Test is outdated, so it's effectiveness in categorizing cryptocurrencies has been questioned.

Why does it matter?

As you might have guessed, it all comes down to taxes and regulations. Commodities are less strictly regulated than securities and are also taxed less. The US Security and Exchange Commission (SEC), chaired by former crypto proponent Gary Gensler, is pushing to heavily regulate cryptocurrencies and the exchanges that trade them, in the same way that stocks and stock exchanges are regulated. Obviously, the exchanges (and the crypto community in general) are pushing back, resistant to the increased regulation and taxation.

Today, the US Committee on Banking, Housing and Urban Affairs held a hearing regarding the oversight of the SEC and their handling of this ongoing situation. From what I've seen, it doesn't look like it went great for Gary, but I haven't looked into it too deeply yet.

So why should we, the crypto community, care? Well, if cryptocurrencies are considered securities, then we would pay higher taxes on our profits (yes they exist) than if they were considered commodities. Additionally, it would become more expensive for exchanges to operate, and this cost would likely be passed on to the customer in the form of increased fees. However, regulation by the SEC could offer protection from scams and exchange collapses. In short, it all comes down to finding the right balance.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

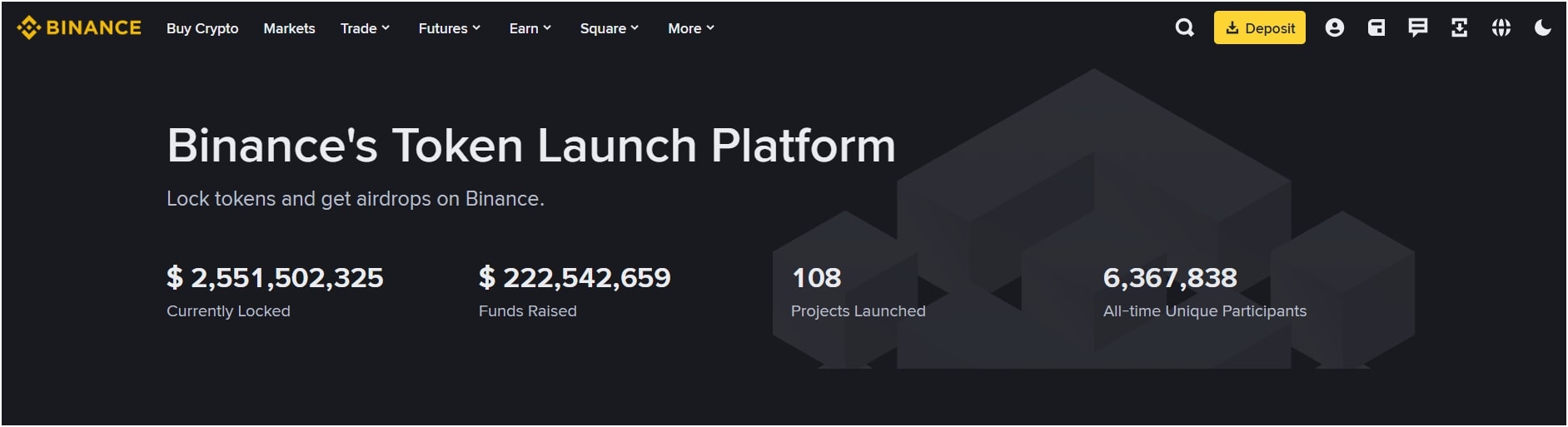

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments