Key Takeaways:

- The SEC approved Bitwise’s 10 Crypto Index Fund conversion to an ETF then abruptly paused the decision.

- The fund would be the first multi-asset spot crypto ETF in the U.S., covering BTC, ETH, XRP, SOL, ADA, and more.

- Industry analysts suspect internal SEC conflict and pending standardization as reasons behind the sudden reversal.

The U.S. Securities and Exchange Commission (SEC) surprised markets this week by approving the conversion of Bitwise’s flagship crypto index fund into an ETF, only to freeze the approval hours later. The unprecedented move is raising questions about the regulatory body’s internal processes and its true stance on crypto-based investment vehicles.

Bitwise ETF Approval Marks Milestone for Crypto

The Bitwise 10 Crypto Index Fund (trading under ticker: BITW) was set to become the first U.S.-listed multi-asset spot cryptocurrency ETF, giving investors exposure to a diversified portfolio of digital assets in a single tradable product. The fund holds approximately 90% of its assets in Bitcoin (BTC) and Ethereum (ETH), with the remainder allocated across eight major altcoins, including XRP, Solana (SOL), Cardano (ADA), Avalanche (AVAX), Chainlink (LINK), Polkadot (DOT), Bitcoin Cash (BCH), and Uniswap (UNI).

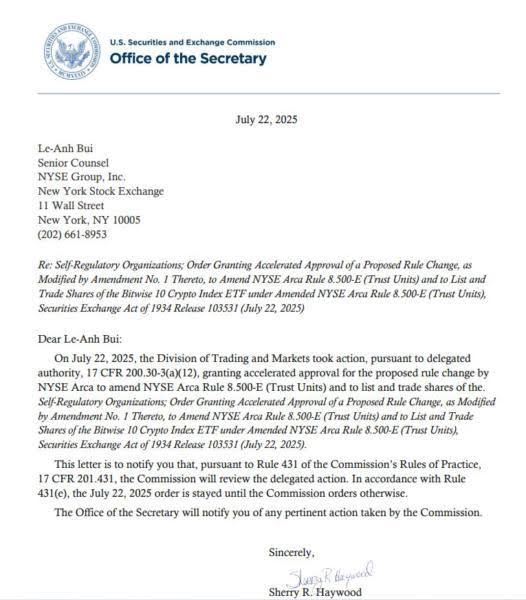

On July 22, 2025, the SEC’s Division of Trading and Markets granted accelerated approval for the listing under the amended NYSE Arca Rule 8.500-E. This gave Bitwise the green light to launch what would have been the most diversified crypto ETF yet on the U.S. market.

The move would have followed a growing trend of institutional adoption of crypto ETFs, especially after the approval of several Bitcoin and Ethereum spot ETFs earlier in 2025, which collectively attracted billions in assets under management.

Bitwise currently manages more than $5.7 billion in crypto-related ETFs. Its spot Bitcoin ETF alone holds about $4.79 billion, while its Ethereum ETF tracks over $430 million in assets. The conversion of BITW into a broader crypto ETF was seen as a natural next step and a milestone for crypto legitimacy in traditional finance.

Read More: Bitwise Moves to Launch Spot Aptos ETF as Price Surges

SEC Reverses Course with Sudden Pause

Just hours after granting approval, the SEC issued a stay order, effectively freezing the listing of the Bitwise ETF until further notice. A letter from Assistant Secretary Sherry R. Haywood confirmed that the commission would review the delegated action under Rule 431(e), pausing the ETF’s launch.

This move immediately followed the SEC’s latest treatment of Grayscale’s Digital Large Cap Fund, a similar multi-asset crypto offering that was granted initial approval only to be put on pause.

In both situations, the regulator has largely relied on process language (followed by a failure to adequately explain the whys) leaving industry experts to speculate and fume.

Read More: Ripple Drops Cross-Appeal in SEC Case, Bringing 4-Year Legal Saga Over XRP Token Sales to an End

What’s Behind the Sudden Reversal?

According to Bloomberg ETF analyst James Seyffart, the stay likely indicates internal disagreement among SEC commissioners or a lack of cohesive standards for approving multi-asset crypto ETFs. Van Buren Capital partner Scott Johnsson went further, calling it “funny business,” suggesting that the move may have been preemptively taken under delegated authority to sidestep expected objections from Democratic Commissioner Caroline Crenshaw, known for her crypto skepticism.

Some are convinced that SEC is playing the waiting game until it can develop a uniform listing requirement to crypto ETFs. According to present regulation, every ETF application should be submitted in the form of a new 19b-4, and in that case, its examination process takes up to 240 days. A new standardized process, expected later in 2025 could significantly shorten timelines and reduce the SEC’s burden.

“They want to put out their generic listing standards first… Get comments. Implement in time [for] October due dates,” Seyffart wrote on X.

Growing ETF Pipeline Reflects Regulatory Shift

The SEC’s docket is brimming with crypto ETF applications, signaling a potential regulatory shift. On the same day Bitwise received its initial approval, the agency also published updates on filings from Fidelity, Invesco Galaxy, Franklin Templeton, and others, primarily seeking to amend redemption mechanics for their existing Bitcoin and Ethereum ETFs.

Meanwhile, several asset managers are pushing forward with more niche crypto ETF proposals. These include products tied to tokens like Sui (SUI) and ONDO, as well as ETFs that track real-world asset platforms.

Although the approval-and-pause strategy has introduced confusion, many analysts believe the regulatory environment is still improving. In fact, Bloomberg’s Seyffart now places 90–95% odds on the approval of spot ETFs for assets like XRP, Litecoin, Solana, and Cardano before year’s end.

Why This Matters for the Crypto Market

The rollercoaster decision regarding Bitwise’s ETF underscores the uncertain but evolving stance of U.S. regulators on crypto. While the SEC appears increasingly open to mainstream crypto products, it also seems hesitant to move forward without a unified approach, especially as crypto tokens become more diverse and complex.

For investors and institutions, this incident highlights two key takeaways:

- Crypto ETFs are coming but not without regulatory friction.

- The SEC is walking a tightrope between enabling innovation and maintaining control.

If finalized, Bitwise’s ETF would represent a major step forward in bringing multi-asset digital exposure to retail and institutional investors alike. But for now, the fate of the fund remains in regulatory limbo, and all eyes are on the SEC for its next move.

The post SEC Pauses Bitwise Crypto ETF Just After Approval; What’s Behind the Shock Decision? appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments