Strategy’s co-founder, Michael Saylor, has again displayed his company’s Bitcoin portfolio tracker, highlighting the current value of its BTC holdings. This comes amid plans to raise up to $2.5 billion through a stock offering for more BTC purchases.

Michael Saylor Showcases Strategy’s Bitcoin Holdings

In an X post, Michael Saylor shared an image of the company’s Bitcoin portfolio tracker, which showed that its 607,770 BTC holdings were currently worth around $71.8 billion. Saylor captioned the post, saying, “It all began with a quarter billion in bitcoin.” This refers to the amount the company initially invested to initiate this Bitcoin Strategy.

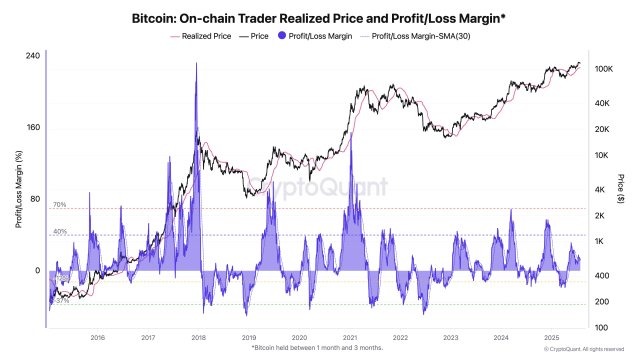

Michael Saylor’s Strategy began buying Bitcoin in August 2020, when they first bought 21,454 BTC worth $250 million. Since then, the company has continued to make massive purchases, bringing its total holdings to 607,770 BTC, which it acquired for a total of $43.61 billion at an average price of $71,756 per BTC. Its latest purchase came between July 14 and 20, when it bought 6,220 BTC.

Thanks to the Bitcoin price appreciation since Strategy began buying BTC, the company now boasts an unrealized gain of around $30 billion on its holdings. It is also worth noting that Michael Saylor’s company is the largest BTC treasury company. The company is well ahead of the other BTC treasury companies, with second-place MARA Holdings holding 50,000 BTC.

Meanwhile, Michael Saylor’s post again hints that the company likely made another purchase in the week ending July 27. A BTC purchase announcement has most times followed his posts on the portfolio tracker. As such, there is the likelihood that the company will announce another Bitcoin purchase today, which it made between July 21 and 27.

Strategy To Raise $2.5 Billion To Buy More BTC

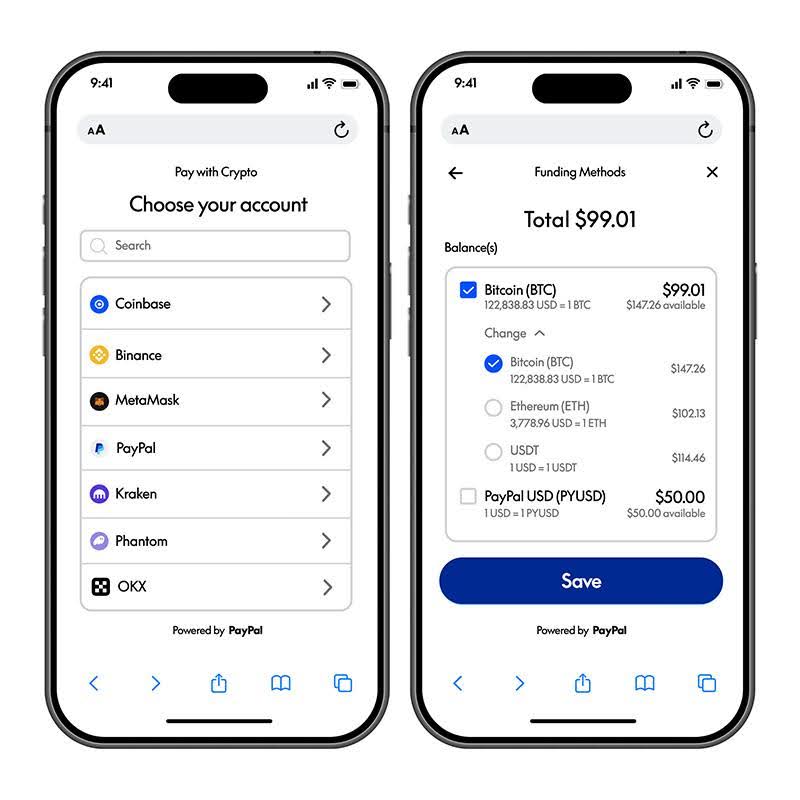

Michael Saylor’s Strategy has also announced plans to raise up to $2.5 billion for more Bitcoin purchases. In a press release, the company revealed that it has upsized its STRC IPO from $500 million to $2.5 billion. The company plans to offer 28,011,111 shares of Variable Rate Series A Perpetual Stretch Preferred Stock at a public offering price of $90 per share.

Strategy plans to issue and sell these STRC shares by July 29. As such, it is unlikely that the latest BTC purchase was made with proceeds from the offering. The company estimates that the net proceeds from the offering will be around $2.474 billion. It also confirmed that the net proceeds will be used for the acquisition of BTC. It is worth noting that Michael Saylor and his company have sold mainly MSTR shares to fund their last two Bitcoin purchases.

At the time of writing, the Bitcoin price is trading at around $119,500, up in the last 24 hours, according to data from CoinMarketCap.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

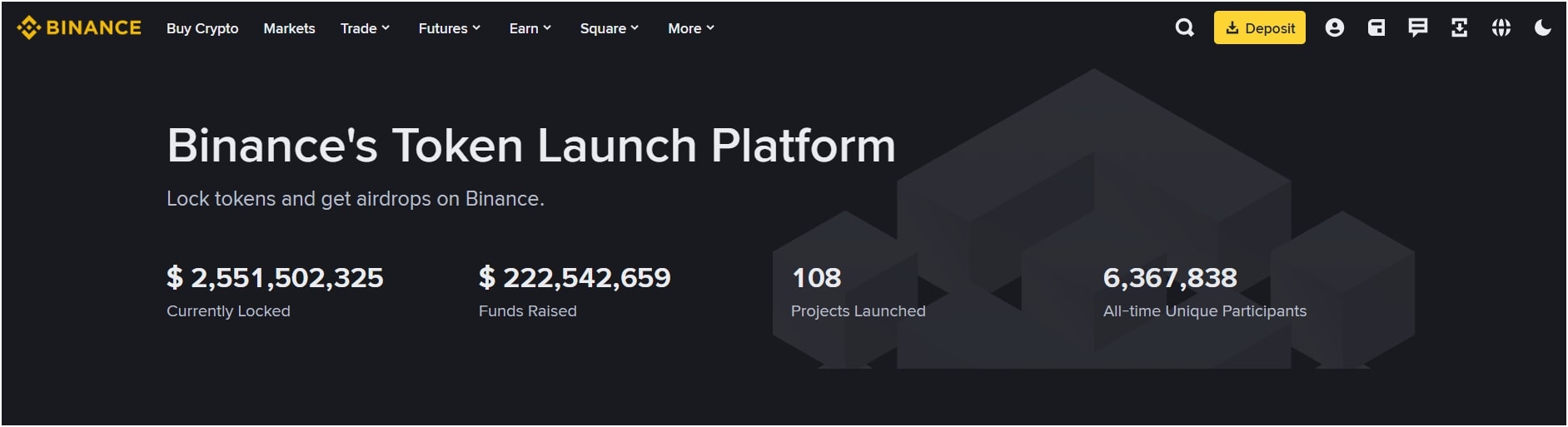

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments