Bitcoin (BTC) is trading steadily above the $105,500 mark as the Asian trading day gets underway on Wednesday.

This comes after a slight correction from the $107,000 level it held during US business hours.

Despite the significant geopolitical upheaval of the past few weeks, including a US strike on Iran that surprised both geopolitical experts and prediction market bettors, Bitcoin has once again demonstrated its resilience as a store of value.

CoinDesk market data shows that the asset class has remained remarkably stable over the last month, up a modest 1%.

A disciplined climb: HODLers stand firm

However, this return to a price point that is within striking distance of Bitcoin’s all-time high of nearly $111,000 (hit in May) feels different this time, according to market observers.

It’s characterized by a sense of discipline rather than the euphoria that often accompanies bull runs.

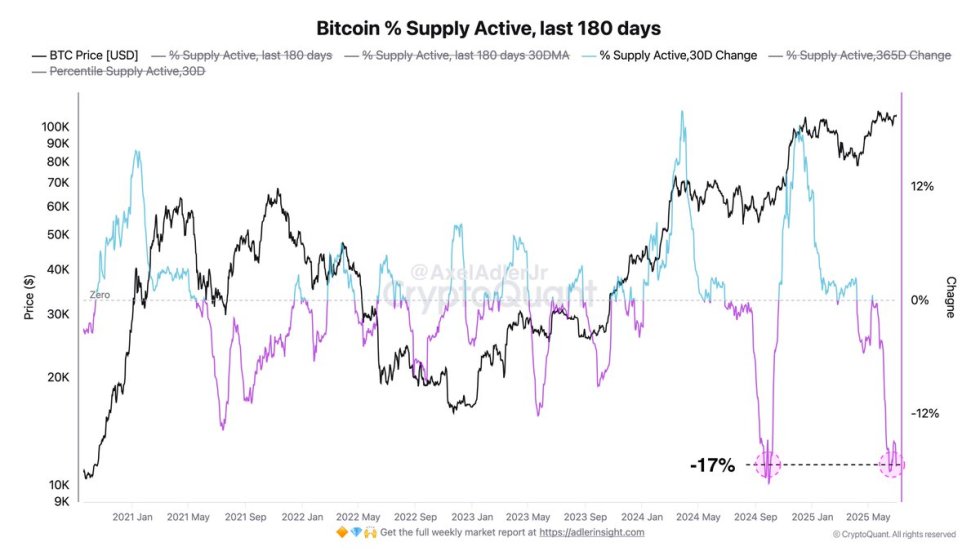

Unlike the breakout above $100,000 in December 2024, which triggered a significant wave of profit-taking, long-term investors now appear content to sit on their unrealized gains.

This observation is supported by analysis from Glassnode in their weekly note.

“HODLing appears to be the dominant market mechanic,” the Glassnode analysts wrote.

They pointed to a surge in the supply held by long-term holders, which has now reached 14.7 million BTC, coupled with historically low levels of realized profits.

This on-chain activity strongly indicates a limited desire to sell, even as Bitcoin trades just below its record highs.

Further reinforcing this narrative of restraint, metrics such as the adjusted Spent Output Profit Ratio (aSOPR) are hovering just above the breakeven point, according to Glassnode.

This suggests that the coins currently being spent are, for the most part, recent acquisitions involved in tactical trades rather than representing a broad distribution or sell-off by long-term holders.

Meanwhile, Glassnode data also shows that the “Liveliness” metric continues to decline, a clear sign that older, long-held coins remain dormant in their wallets.

The institutional undercurrent: steady demand meets rising leverage

This patience from seasoned investors is being met with persistent institutional demand.

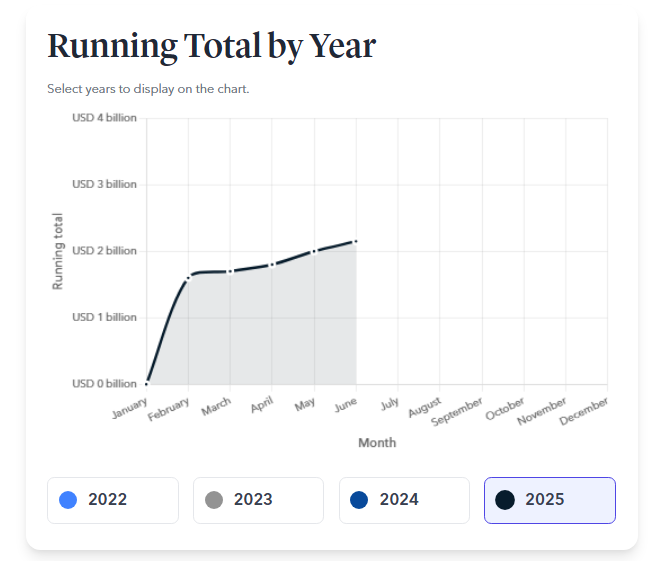

In its daily markets update, trading firm QCP highlighted this trend, noting that market data indicates a substantial $2.2 billion in net inflows into spot Bitcoin ETFs just last week.

QCP described the overall tone of these flows as “constructive” and pointed out that dedicated crypto treasury companies such as Strategy and Metaplanet continue to accumulate Bitcoin.

These steady institutional inflows are quietly but fundamentally reshaping the market’s structure.

Bitcoin’s realized cap—a metric that measures the price at which coins last moved on-chain—has grown to an impressive $955 billion.

This growth is widely seen as a sign that real, committed capital, not just fleeting speculation, is flowing into the asset.

A fragile equilibrium: the standoff in the market

However, not everything is calm beneath the surface. QCP’s report also noted that leveraged long positions have been on the rise, with funding rates turning positive across major perpetual futures markets.

This indicates that short-term traders are increasingly using leverage to bet on further price increases.

Glassnode, in its analysis, warns that this situation may not be sustainable indefinitely. “The market may need to move higher, or lower, to unlock additional supply,” the firm wrote, suggesting that the current equilibrium between the unwavering conviction of long-term holders and the increasing leverage of short-term traders won’t hold forever.

Even major political news, such as the US Senate’s approval of the White House’s “Big Beautiful Bill,” has failed to produce a significant price reaction from Bitcoin.

This has led to a market that feels less like a stampeding bull run and more like a tense standoff. On one side are the long-term holders who are refusing to sell, and on the other are the short-term traders piling into leveraged positions.

This fragile equilibrium has market observers on the edge of their seats, wondering where the next major catalyst will come from and whether it will make Bitcoin’s next move an explosive one.

The post BTC trades stably near $105.5K; institutional ETF inflows reached $2.2B last week appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments