- Bitcoin price fell 3% to below $115k, with intraday lows of $114,750.

- Galaxy Digital has deposited over 30,000 BTC.

- Lookonchain shared on-chain details indicating Galaxy sold over 10k on Binance, OKX and Bybit.

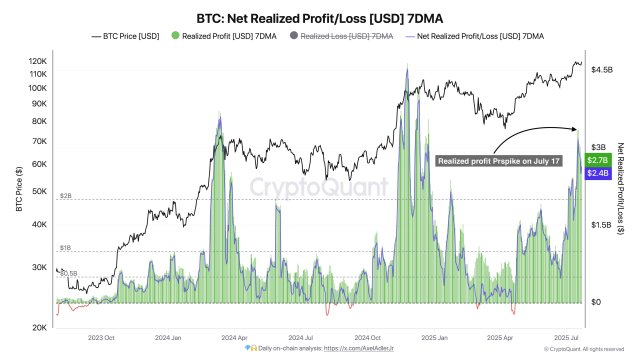

Bitcoin (BTC) fell sharply on Friday, touching lows near the $115,000 mark, as analysts pointed to a sell-off by a long-dormant Bitcoin whale.

Bitcoin, which recently hit an intraday high of $123,000, gave up gains to trade as low as $114,759 — down 3% over 24 hours.

The move marked its lowest level in two weeks, last seen on July 10, when BTC surged from $110,000.

Why did the Bitcoin price fall sharply today?

Bitcoin, which had recently consolidated in the $117,000&-$118,000 range as altcoins outperformed, broke below key support levels to hit a multi-week low amid heavy selling pressure.

The decline follows on-chain activity suggesting that a long-dormant wallet, active for the first time in 14 years, moved 80,000 BTC to exchanges through Galaxy Digital.

Data indicates the holdings may have been offloaded in the past 24 hours.

“Note that Galaxy Digital has deposited over 10,000 $BTC ($1.18B) to exchanges in the past 8 hours! The 10,000+ $BTC comes from the Bitcoin OG holding 80,009 $BTC($9.68B),” Lookonchain posted on X.

Lookonchain then shared an update showing over 30k BTC sent to exchanges, including Binance, OKX and Bybit. Currently, Galaxy has transferred over 30k BTC to exchanges.

Also notably, Galaxy withdrew $1.15 billion USDT from exchanges after the BTC deposits.

Update:#GalaxyDigital has transferred nearly 30,000 $BTC($3.5B) out today, most of which went directly to exchanges and were sold.

Then #GalaxyDigital withdrew 1.15B $USDT from exchanges.#GalaxyDigital still holds 18,504 $BTC($2.14B).https://t.co/bVtNwP2iXI pic.twitter.com/Wv1cD3aHbf

— Lookonchain (@lookonchain) July 25, 2025

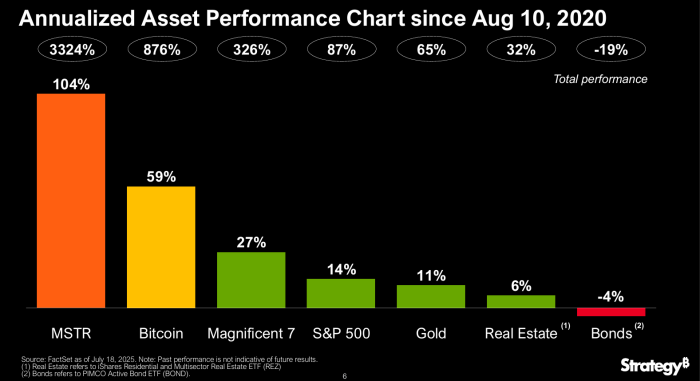

Over $518 million liquidated

Per details on Coinglass, the BTC sell-off has erased over $518 million in leveraged positions within the last 24 hours.

Most of these are longs at over $380 million, with more than $135 million of it in bullish bets on BTC wiped out.

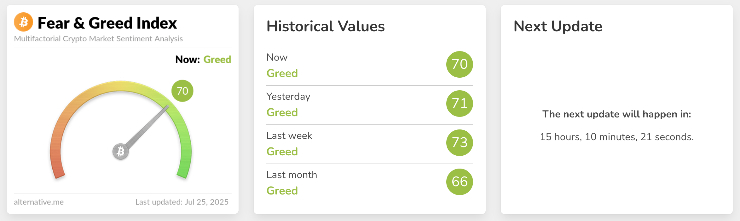

The whale’s activity is thus likely to have an impact, largely panic selling that could further push prices lower.

Liquidations mounting will see more longs taken out, with some like AguilaTrades already seeing millions in potential profits disappear.

What’s next for the Bitcoin price?

According to crypto analyst Captain Faibik, while bulls may yet retain the upper hand, a breakdown is likely.

The analyst points to a falling wedge pattern and says a daily close below $113k could confirm this negative outlook.

However, if BTC holds steady and moves toward $118k, a decline in selling pressure may allow buyers to retest key supply zone areas.

$BTC is on the verge of breaking down from its Rising Wedge..!!

A daily close below 113k would confirm the Breakdown, Potentially triggering a Correction..🔜📉

Still Waiting for confirmation before taking any action..⏰#Crypto #Bitcoin #BTC https://t.co/KZctibiLlZ pic.twitter.com/qon77TXtDH

— Captain Faibik 🐺 (@CryptoFaibik) July 25, 2025

As the market reacts to the Bitcoin price drop, investors may want to position themselves amid buy-the-dip opportunities.

In this case, Bitcoin’s next move is very much a key factor.

The post Bitcoin drops to $115k as Galaxy Digital dumps 30,000 BTC appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments